After experiencing a massive drop last quarter, insurtech funding levels off in Q2'22.

After dropping 56% quarter-over-quarter (QoQ) in Q1’22, global insurtech funding stayed flat at $2.4B in Q2’22. Insurtech deals, however, did drop 16% QoQ to hit 132, the lowest count since Q4’20.

Below, check out a handful of highlights from our 118-page, data-driven State of Insurtech Q2’22 Report. Clients can dig into deeper insights, all the record figures, and a ton of private market data by downloading the full report using the sidebar.

For more on the broader fintech landscape, check out our State of Fintech Q2’22 Report.

Q2’22 highlights across the insurtech venture ecosystem include:

- $100M+ mega-round funding share came in at 38% in H1’22, falling below 40% for the first time since 2018.

- Europe global deal share rose by 7 percentage points QoQ, the most significant jump relative to other global regions. Ultimately, 29% of insurtech deals went to Europe-based companies — the region was second behind only the US.

- Life & health insurance funding rose 13% QoQ in Q2’22, nearly hitting $1B. Top deals went to Alan ($193M Series E) and Clarify Health ($150M Series D). P&C insurance funding, on the other hand, dropped 6% QoQ.

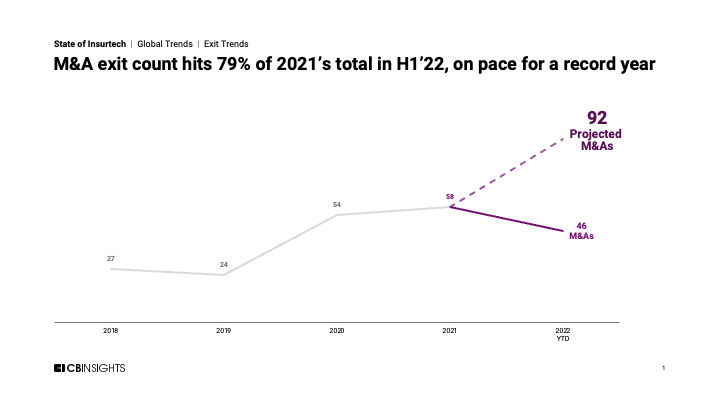

- Insurtech M&A exit count (46) reached 79% of 2021’s full-year total in H1’22.

Clients can download our Q2’22 State of Insurtech Report to dive into all these trends and more.