Eight of the ten largest rounds in Latin America went to Brazilian tech.

Investors from around the globe are flocking to Latin America — within the first half of 2018, deep-pocketed investors like Andreessen Horowitz, Sequoia Capital, and DST Global have backed startups in the region.

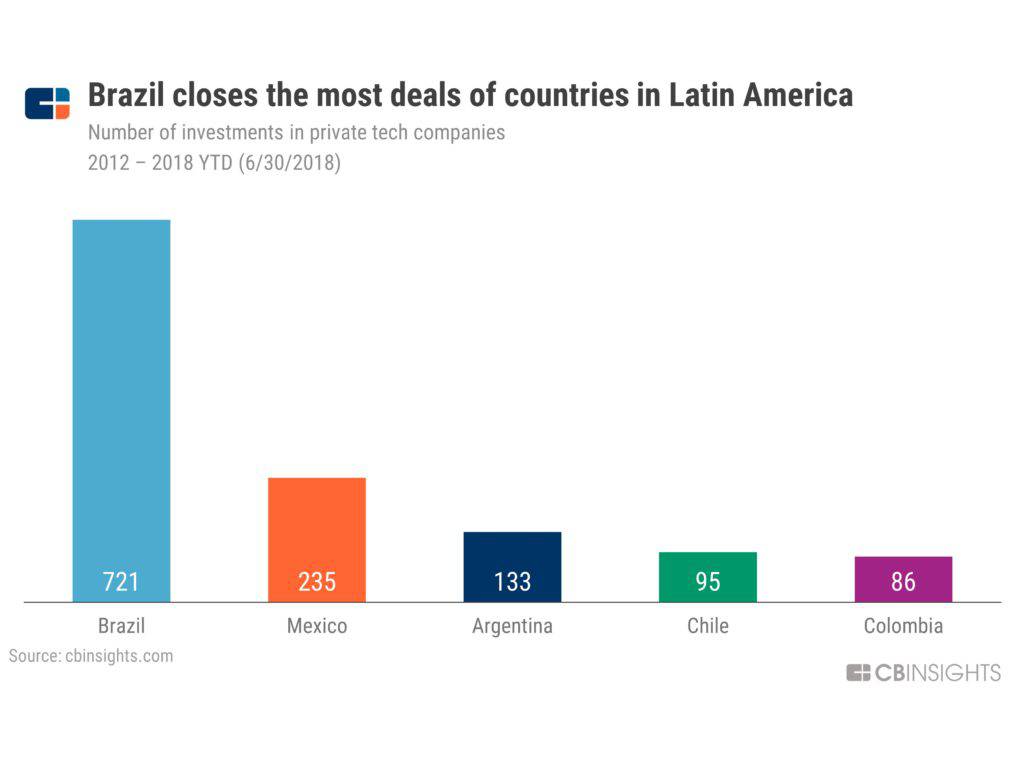

Private technology companies in Latin America have raised over $5.8B in funding since 2012. Within Latin America, Brazil stood out for the attention it received. It attracted over three times the number of deals as Mexico.

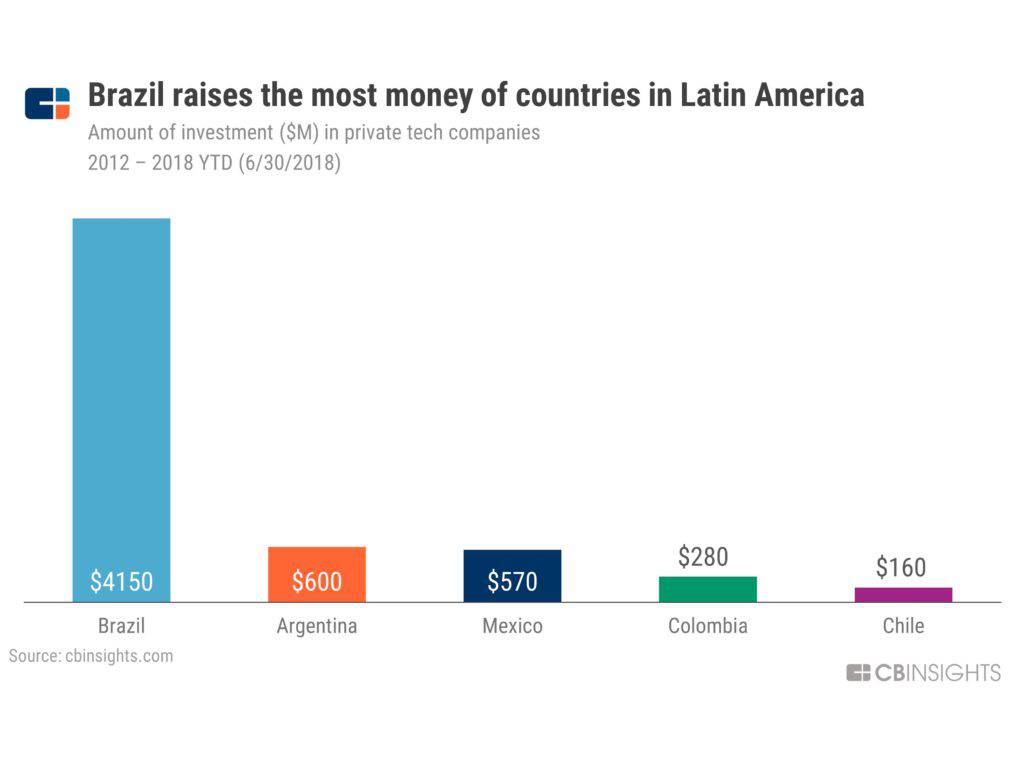

Investment totals further amplified the skew toward Brazil, with the country raising $4.2B in deals since 2012 — nearly seven times as much as either Mexico or Argentina. Despite closing fewer deals, Argentina brought in approximately $600M worth of deals, slightly above Mexico at about $570M.

MEGA-ROUNDS TO BRAZIL EXPLAIN THE SKEW

Brazil’s large share of regional investment was propelled by mega-rounds (deals above $100M) to the country’s startups. Brazilian companies represented eight of the 10 largest rounds in Latin America since 2012.

The biggest round, however, went to Argentina’s Decolar, which received a $270M corporate minority round in Q1’15 from Expedia. Decolar runs online accommodation and flight booking sites across several countries in Latin America. It went public in Q4’17 and was valued at $1.7B at the time.

Nubank, a Brazil-based fintech that is the most well-funded startup in Latin America, also closed one of the region’s largest rounds, with a $150M Series E round in Q1’18 that included DST Global and Founders Fund.

In total, Nubank has raised $605M in funding across 10 rounds and is considered a unicorn (valued at $1B+). Nubank’s other investors include Tiger Global, Sequoia Capital, and Goldman Sachs.

Other significant deals include those to Brazil’s 99, which raised two rounds worth $100M in Q1’17 and Q2’17. The first round was a Series C round that included Chinese ride-hailing unicorn Didi Chuxing and the second was a private equity round from SoftBank Group.

99 is a ride-hailing company that has also raised funding from Qualcomm Ventures and Tiger Global Management.

| Rank | Company | Round | Date | Amount ($M) | Select Investors | Country |

|---|---|---|---|---|---|---|

| 1 | Decolar | Corporate Minority | 3/10/2015 | 270 | Expedia | Argentina |

| 2 | Ascenty | Private Equity – III | 3/14/2017 | 190 | Blackstone Group | Brazil |

| 3 | Rappi | Series C | 1/18/2018 | 185 | Andreessen Horowitz, Delivery Hero, Sequoia Capital | Colombia |

| 4 | Netshoes | Series B | 5/8/2014 | 170 | GIC, Tiger Global Management, ICONIQ Capital | Brazil |

| 5 | MUTANT | Private Equity | 8/29/2016 | 155 | Permira, Technology Crossover Ventures | Brazil |

| 6 | Nubank | Series E | 3/1/2018 | 150 | DST Global, Founders Fund, QED Investors | Brazil |

| 7 | Ascenty | Private Equity | 11/29/2014 | 130 | Great Hill Partners | Brazil |

| 8 | 99 | Private Equity | 5/24/2017 | 100 | SoftBank Group | Brazil |

| 8 | 99 | Series C | 1/4/2017 | 100 | Didi Chuxing, Riverwood Capital | Brazil |

| 9 | Movile | Series H | 12/7/2017 | 82 | Innova Capital, Naspers | Brazil |